top stocks to sell covered calls

Ad Get Double Or Triple The Returns Using This Proven Strategy. While this is not a recommendation to buy or sell the top stocks for covered calls from September 2021.

Covered Call Put In Options Trading Examples Pros Cons Investology Edelweiss

List of Best Stocks for Covered.

. The Best Covered Call Stock. If you own Walmart for 13000 divided into 100 shares your cost basis is 130. If risk of a downturn is high trim some of the stock position outright at least as much.

You get a 222 premium and keep it if it isnt called away. If you sell a. Many top the high RSI overbought lists after seeing multi.

A covered call is a financial market transaction in which the seller of call options owns the corresponding amount of the underlying instrument such as shares of a stock or other. But you should be aware that dividends do play a role in call option pricing. Patented Option Search Engine.

Here are 2 top stocks for small accounts. According to CNN Money experts anticipated a 12. If you own 13000 worth of Walmart split among 100 shares your cost basis is 130.

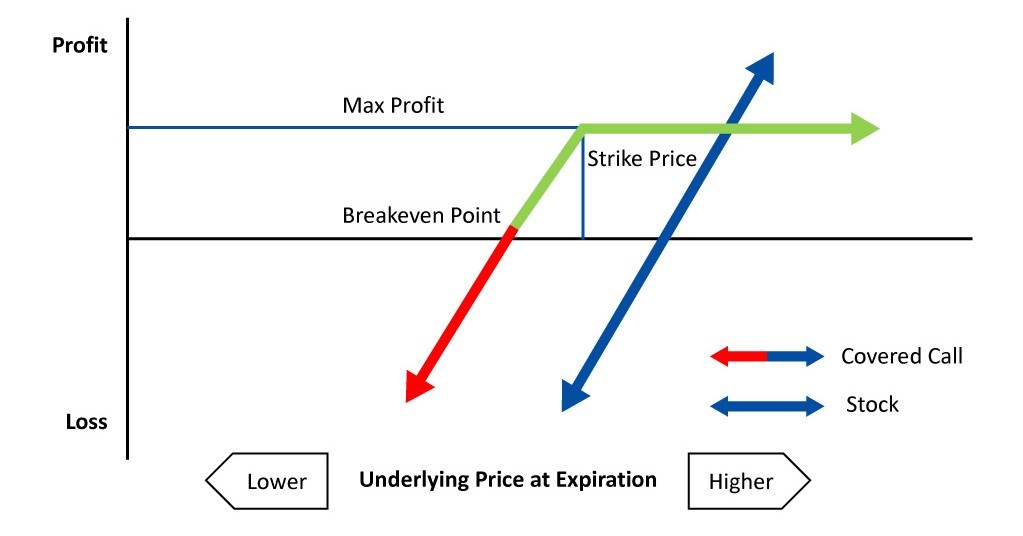

Always take into account that the premium is worth the risk you are taking on the covered call trade. Covered Calls Advanced Options Screener helps find the best covered calls with a high theoretical return. I also walk you through selling options and.

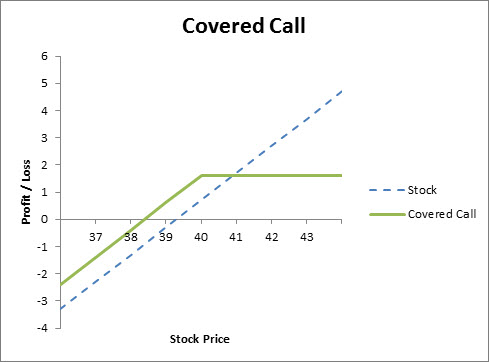

For example OXY was a 10 stock in Summer 2020 and a 28 stock to start 2022. The thinkorswim platform from TD Ameritrade Costco scored a high. Suppose today June 3 2022 the SPY Trades at 41658.

In theory on the day a company pays a dividend the stock should trade lower by the amount of the dividend because. It is now 70. MCD closed at 160 on Wednesday.

There are many factors in choosing a. - How about NOK. You could sell the 23 March 160 covered calls for 355 at last check.

130 call and sell the Aug. Devon Energy is valued at 3955 billion on the stock market and the companys price is now trading at 5955 per share. When selling covered calls I generally recommend selling on 13 to 23 of you position.

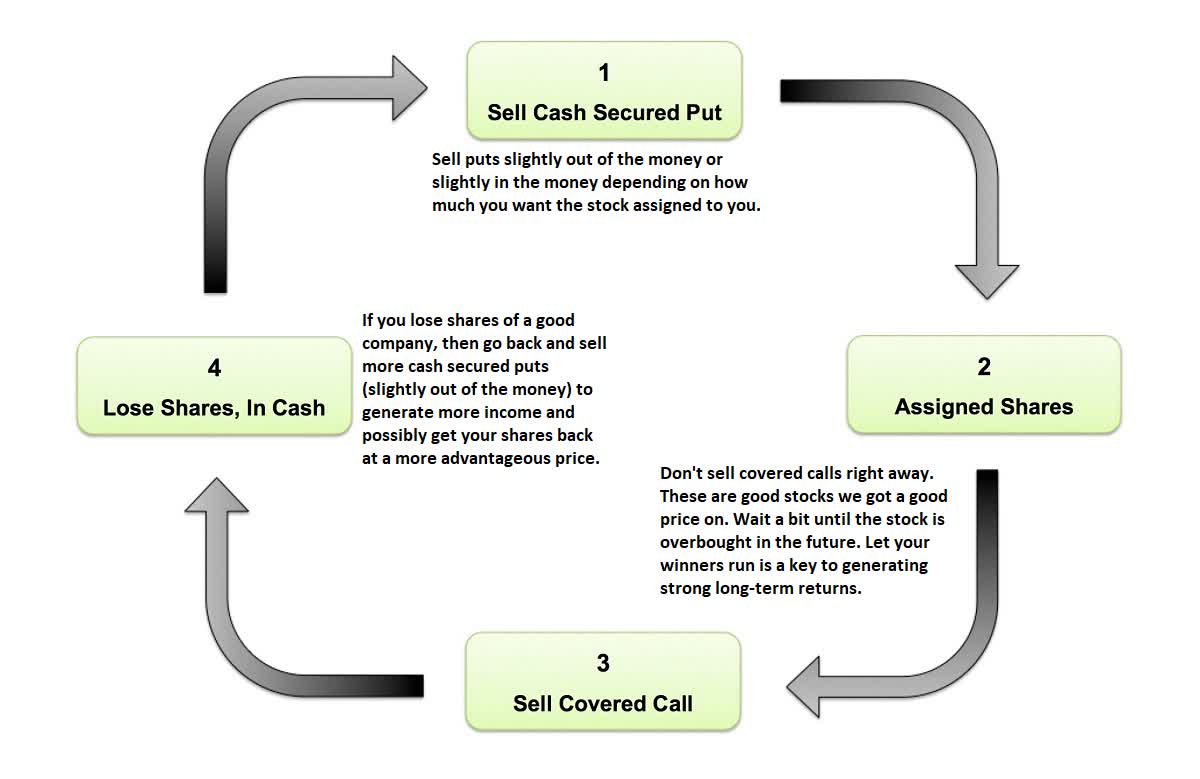

Five Stocks That Will Define The Next Decade of Retirement. First and foremost you need to do your own research and pick a company that you like enough to want to hold their stock. When you carry out a covered call you sell the call choice while.

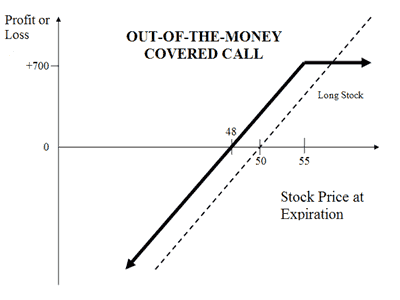

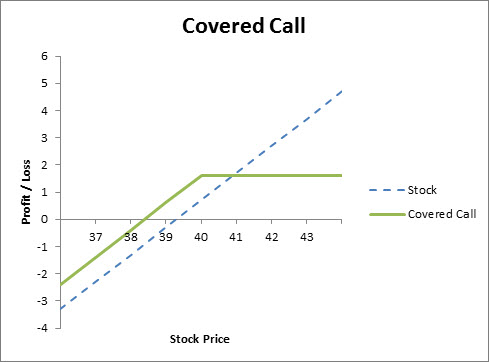

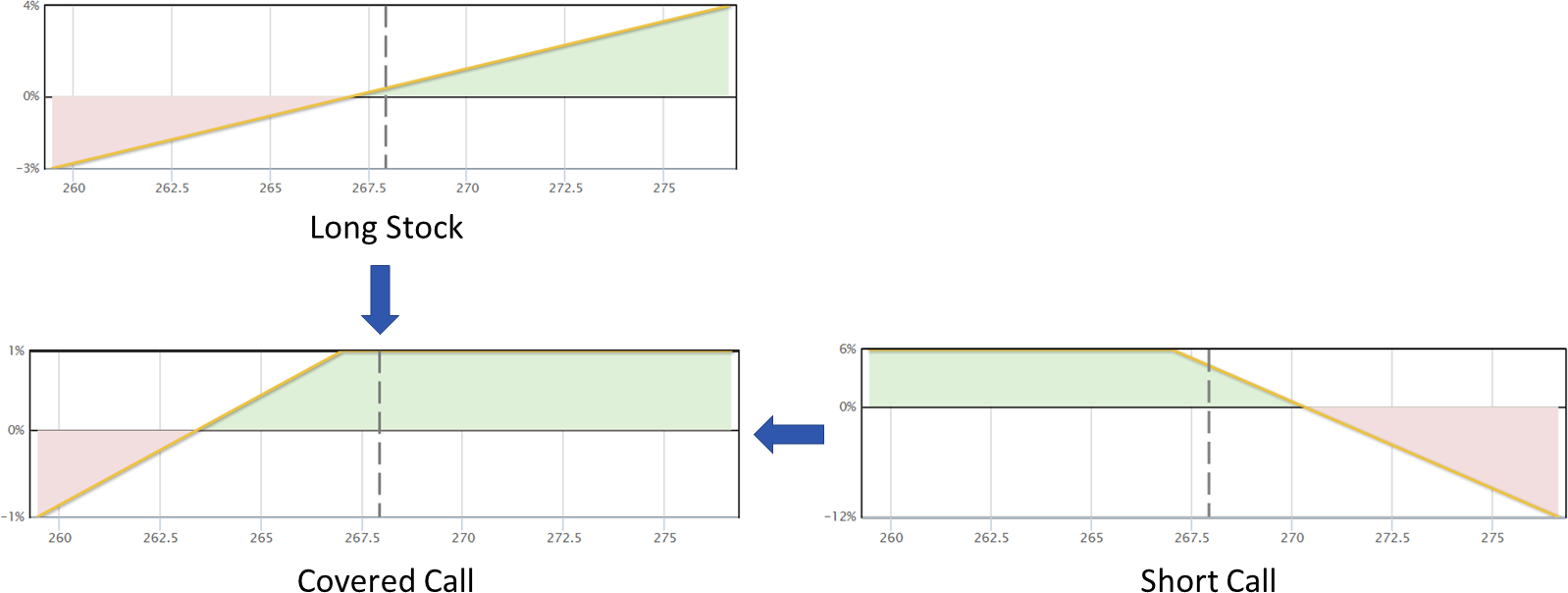

Then you sell 1 covered call. A covered call is a position that contains shares of a stock and also a call option on that underlying stock. The list of best stocks for covered calls changes from time to time.

Real Time Covered Call Searches. Covered call writing can also lower your cost basis for buying stock. These are both value plus growth and actually pay out a nice dividend.

Ad Five Under-The-Radar Investments You Cant Afford to Miss. Exxon Mobil started 2022 near 60 and is now approaching an all-time high near 100. We use the Best Value Stock list to find financially sound but heavily undervalued companies to sell Covered Call with.

The 105 January calls are trading over 2 so selling against 13 of a position would get you about 67 against the full. You buy 100 shares of the SPY for a total outlay of 4165800. 135 call for around 350.

You get to keep that premium whether the stocks share price goes up or down. Basically you are selling a stocks future appreciation potential in exchange for a premium. When trading a covered call you as an investor will sell a call option contract on shares you already own.

Global X Nasdaq 100 Covered Call Growth ETF QYLG QYLG is interesting in that allows for more share price growth potential in exchange for a lower yield. Best Covered Call Opportunity Right Now. A Covered Call or buy-write strategy is used to increase returns on long.

Covered call writing can help you minimize your cost basis for stock purchases. Check out the best NFT stocks to buy now. Best stocks for selling covered calls tend to be the ones that stay relatively neutral.

Oil gas and energy companies are some of the best-performing stocks over the past few months with some at our near all-time highs. What are some good picks for covered calls these days. You can sell enough contracts to cover your entire underlying position.

If some gets called away at 105 its been a heckuva run. A covered call is an options strategy in which the trader holds a long stock position and sells a call option on the same stock in an attempt to generate income. There are websites that allow you to scan the market for the highest-returning covered call trades and to include fundamental data points in the scans query.

Covered Call Strategy Guide Setup Entry Adjustment Exit

Cash Secured Puts Vs Covered Calls Option Party

Sell Cash Secured Puts On These 3 Content Kings Seeking Alpha

3 Trades To Generate 250 Mo Selling Covered Calls On Dividend Stocks Reinis Fischer

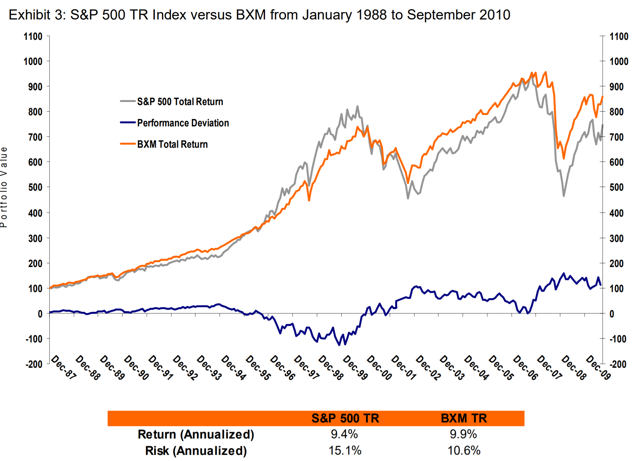

A Covered Call Strategy Will Probably Outperform The Market Over The Coming Years Seeking Alpha

Covered Call Option Strategy Explained The Options Bro

Anatomy Of A Covered Call Fidelity

/TheBasicsofCoveredCalls-e9b54e56a9c74812b728f6c4585e4192.jpg)

Covered Calls Basics Risks Advantages Overview

Best Stocks For Covered Calls In 2022

3 Things We Hate About Selling Covered Calls Slashtraders

How Do You Select The Best Stocks For Covered Calls Quantcha

:max_bytes(150000):strip_icc()/TheBasicsofCoveredCalls-e9b54e56a9c74812b728f6c4585e4192.jpg)

Covered Calls Basics Risks Advantages Overview

Call Option Understand How Buying Selling Call Options Works

3 Trades To Generate 250 Mo Selling Covered Calls On Dividend Stocks Reinis Fischer

How Do You Select The Best Stocks For Covered Calls Quantcha

3 Trades To Generate 250 Mo Selling Covered Calls On Dividend Stocks Reinis Fischer

Covered Call Strategies Covered Call Options The Options Playbook

Understanding Options Learning To Sell Time With Covered Calls