working capital turnover ratio ideal

Current ratio is also known as liquid ratio. Return on Assets ROA Ratio.

Internal Rate Of Return And Time Weighted Return In 2022 Financial Analysis Portfolio Management Financial Management

Cherry Woods Furniture is a specialized supplier of high-end handmade dining sets made from specialty woods.

. Working Capital Management in Indian Paper Industry. Ratio analysis can be defined as the process of ascertaining the financial ratios that are used for indicating the ongoing financial performance of a company using a few types of ratios such as liquidity profitability activity debt market solvency efficiency and coverage ratios and few examples of such ratios are return on equity current ratio quick ratio. Accounts Payable Turnover Ratio can be defined.

We would like to show you a description here but the site wont allow us. The compression ratio is the ratio between two elements. Operating Income.

We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply. Thus an ideal capital structure is one that provides enough cushions to shareholders so that they can leverage the debt-holders funds but it should also provide surety to debt holders of the return of their principal and interest. ABCs Current Ratio is better than XYZ which shows ABC is in a better position to repay its current obligations.

On the other hand a value below 1 could indicate that the business is losing money. Debt comes in the form of bond issues or long-term notes. Use the following formula to calculate stock turnover.

Inventory Turnover Ratio Examples. Negative working capital on a balance sheet typically means a company is not sufficiently liquid to pay its bills for the next 12 months and sustain growth. The reason of computing absolute liquid ratio is to eliminate accounts receivables from the list of liquid assets because there may be some doubt about their quick collection.

Net Working Capital Ratio. Ideal current ratio is 21. Over Q3 its busiest period the retailer posted 47000 in COGS and 16000 in average inventory.

Negative Working Capital. Get 247 customer support help when you place a homework help service order with us. Liquidation of the Firm.

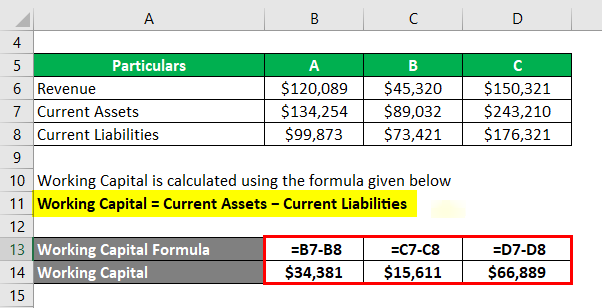

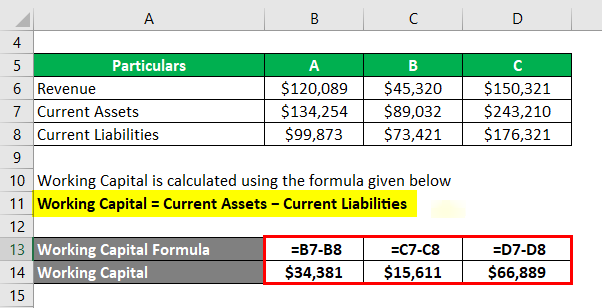

However companies that enjoy a high inventory turnover and do business on a cash basis require very little working capital. To find the inventory turnover ratio. Working capital turnover ratio Net sales Working capital.

Inventory Turnover Ratio Cost of Goods Sold Avg. Since capital structure ratios reveal these facts analyst pay careful attention to them. This helps people work in such a way that their activities are aligned with the organization strategy and helps individual work areas contribute to overall business.

Working Capital Current Assets - Current Liabilities 6 Tableau Finance Dashboard Metric. A set of Trend Data Driven Chart are included. Working Capital Management Definition The term working capital management primarily refers to the efforts of the management towards effective management of.

Definition of Ratio Analysis. The capital structure is how a firm finances its overall operations and growth by using different sources of funds. An ideal situation is where performance indicators cascade down through an organization.

Ideal for Quarterly Reviews or Annual presentations. On how to start an auto parts business to figure out what the market for the business looks like and what services are ideal to be included in your start-up. In an ideal scenario it makes more sense to track the value of this metric over a period of time.

The gas volume in the cylinder with the piston at its highest point top dead center of the stroke TDC and the gas volume with the piston at its lowest point bottom dead center of the stroke BDC. Liabilities and Capital. 60 of companies investing in data-based HR technology said they had average turnover rates of up to 20 and 25 of the organizations had turnover rates of up to 50 71 of Millennials say an organizations view of technology will influence whether they want to work there and 66 of Gen Xers and 53 of baby boomers feel similarly CompTIA.

A ratio analysis is a quantitative analysis of information contained in a companys financial statements. Also known as stock turn inventory turns and stock turnover this formula is calculated by dividing the cost of goods sold COGS by average inventory. What is a Good Inventory Turnover Ratio.

Inventory turnover is a ratio showing how many times a business sold and replaced inventory over a given time period. It is calculated by adding total cash and equivalents accounts receivable and. However a capital-intensive company will have a different ratio and in the case of negative working capital the ratio might reverse in most cases.

A KPI Tree is a visual method of displaying a range of measures in an organization or related to a project. The ideal ratio should be 2 is to 1 in the case of manufacturing companies. The compression ratio of an engine is a very important element in engine performance.

An absolute liquid ratio of 051 is considered ideal for most of the companies. Income and Expenses Chart. A STUDY ON RATIO ANALYSIS AT AMARARAJA BATTERIES LIMITED ARBL A PROJECT REPORT MASTER OF BUSINESS ADMINISTRATION Under the Guidance of.

Ratio analysis is used to. Long term solvency ratio is the same as_____ current ratioacid-test ratio debt-equity ratio 5. The Quick ratio Quick Ratio The quick ratio also known as the acid test ratio measures the ability of the company to repay the short-term debts with the help of the most liquid assets.

The World Bank is also asking states to eliminate all these different taxes and fees in the states for the small businesses focus on a simple turnover base tax with 2 or 3 percent of turnover so it is easy to calculate and have an electronic platform through which that tax can be paid for small businesses with a turnover less than N25 million. False Working Capital Ratio. Debt to Equity Ratio.

However it is an ideal strategy but involves a high risk of bankruptcy. This ratio is useful only when used in conjunction with current ratio and quick ratio.

Capital Structure Theory Modigliani And Miller Mm Approach Social Media Optimization Learn Accounting Accounting And Finance

Recapitalization Money Management Advice Learn Accounting Accounting Education

Capital Turnover Definition Formula Calculation

Working Capital Turnover Ratio Formula Example And Interpretation

Working Capital Turnover Ratio Different Examples With Advantages

How To Calculate Working Capital Turnover Ratio Flow Capital

Privately Held Company Accounting And Finance Business And Economics Business Finance

Working Capital Turnover Ratio Different Examples With Advantages

Working Capital Turnover Efinancemanagement Com

Working Capital Turnover Ratios Universal Cpa Review

Factors Affecting Capital Structure Decisions In 2022 Financial Management Accounting Books Equity Capital

Working Capital Turnover Ratio Download Scientific Diagram

Activity Ratio Formula And Turnover Efficiency Metrics Excel Template

Working Capital Turnover Ratio Meaning Formula Calculation

Debtors Receivable Turnover Ratio And Collection Period Financial Analysis Business Financial

Working Capital Turnover Ratio Different Examples With Advantages

Advantages And Disadvantages Of Npv Learn Accounting Accounting Classes Accounting And Finance

Factors Determining Working Capital Requirement In 2022 Accounting Books Accounting And Finance Factors

Working Capital Estimation Operating Cycle Method Learn Accounting Accounting And Finance Accounting Education